In today’s fast-paced business landscape, effective accounting practices are more crucial than ever for ensuring financial stability and driving strategic decision-making and an ERP can help businesses in Resolving Accounting Challenges with Efficiency and Precision.

What is Accounting and Why It Matters

Accounting is a system that measures and communicates important financial information about a business. It helps answer key questions like:

- Is the business making money? If yes, how much profit?

- Does the business have enough cash available?

- What are the assets and debts of the business?

Good accounting helps business owners make wise choices. It creates clarity on how the business stands financially.

Brief History of Accounting

Accounting methods have been used for thousands of years. But modern accounting started during the Renaissance time over 500 years ago. An important development was “double entry” bookkeeping. This means carefully recording every business deal in two accounts. This helped reduce errors and improved the accuracy of financial records.

Over time, accounting evolved into a key business management tool used widely today. Recent international accounting standards have also improved financial transparency across countries.

Key Accounting Principles

Certain guidelines called Generally Accepted Accounting Principles (GAAP) govern accounting. Following GAAP principles ensures consistency and clarity of financial statements. Some key principles are:

- Accrual Basis: Record income and expenses when they occur, not only when cash changes hands.

- Matching Concept: Match expenses to the specific income it helped earn.

- Consistency: Use the same accounting treatments consistently over reporting periods.

These make financial reporting more realistic and reliable for decision-making.

The Accounting Equation

A simple but powerful concept forms the accounting foundation:

Assets = Liabilities + Equity

Here is what each part means:

Assets – Resources of value owned by the business like cash, equipment, and real estate.

Liabilities – Debts and obligations owed by the business like loans, unpaid bills, etc.

Equity – Initial investment amount plus cumulative business profits over time.

This equation always needs to balance out, ensuring accounts reconcile.

Key Financial Statements

Accounting data comes together in three main financial statements for better business insights:

- Balance Sheet: Shows assets, debts and equity on a certain date. Adheres to the accounting equation.

- Income Statement: Sums up revenues, costs, and profits over a period. Helps understand profit drivers.

- Cash Flow Statement: Shows money flowing in and out from business activities. Indicates liquidity.

Analyzing Statements for Best Results

Simply preparing statements is not enough. Further analysis identifies trends and ratios for deeper insights:

- Horizontal Analysis: Compare data across recent years to spot trends.

- Vertical Analysis: Express items as percentages of totals like revenue.

- Ratio Analysis: Evaluate margins, turnover rates, debts, and liquidity metrics.

This analysis turns accounting data into wise business strategy.

In summary, accounting forms the bedrock for measuring and monitoring business financials. Mastering key concepts and statements helps drive fruitful decision-making.

Demystifying Assets, Liabilities, and Equity

Assets are economic resources owned by a business, categorized into:

- Current Assets: Cash and assets that can convert into cash within a year (for example accounts receivable, inventory)

- Long-term Assets: Illiquid assets providing future economic benefit exceeding one year (for example buildings, equipment, trademarks)

Liabilities refer to financial obligations a business owes to outside parties, grouped into:

- Current Liabilities: Debts payable within 12 months (for example accounts payable, wages payable)

- Long-term Liabilities: Obligations with over 1 year repayment period (for example bank loans, bonds payable)

Finally, Equity or shareholders’ equity refers to residual claims on assets after settling liabilities. It equals initial capital invested plus accumulated net income over time.

Principles Guiding Revenue and Expense Recognition

Revenue gets recognized when:

- Significant goods transfer or services rendered to the customer

- Earning process is completed for the transaction

- Revenue amount can be reliably measured

Expenses are recognized in the same reporting period as the:

- The revenue they helped generate per matching principle

- Loss or consumption of assets occurs

These principles ensure revenues and expenses get reported in the correct period.

Appreciating the Need for Accurate Financial Statements

Reliable financial statements are vital for:

- Internal Users: Owners and managers use statements for steering the business by formulating strategy and operational decisions.

- External Users: Investors analyze statements to decide on providing debt or equity financing, assessing investment returns and risk. Lenders also evaluate statements to decide on extending credit.

Even governments use statements for taxation purposes. Therefore, the accuracy of financial statements is crucial for optimal economic decision-making by various stakeholders. Following accounting concepts and standards ensures such accuracy.

In summary, core accounting seeks to measure and reflect the real economic condition of any business. Mastering the key ideas equips one to produce and leverage quality financial data.

The synergy between Versa Cloud ERP and an Accounting function

Crafted to simplify complex financial management, while making it simple. With customizations and automation tailored to your workflows, Versa Cloud ERP seamlessly integrates data across purchase, inventory, sales, accounting, and much more. No more grunt work reconciling numbers across systems. Just pure unified insights to drive your next big move.

With interactive dashboards tracking revenues, costs, and profits down to each penny, you can finetune financial performance faster than saying “Show me the money”.

Give your finances the platform they deserve today with a free trial. Let the number crunching begin!

Empower your business with streamlined accounting processes with Versa Cloud ERP.

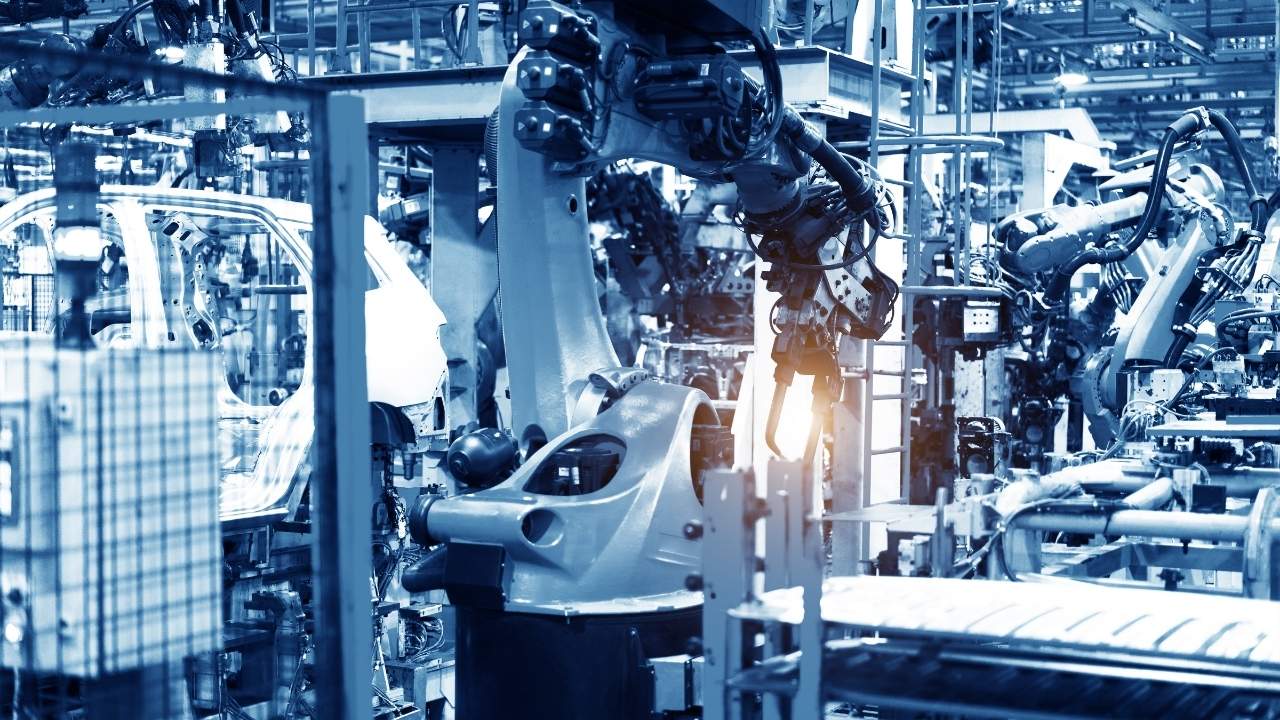

With Versa Cloud ERP’s Implementation guide learn how a Manufacturing business can ensure a successful ERP Solution Implementation. Navigate the complexities of implementation with confidence!

A Small Business in the modern day with Omnichannel Retail is complex and requires resources to deliver on its goals and achieve its full potential. To create a small business success story business owners need an ERP Solution that grows with them.

Effectively manage your financials, accounting, inventory, production, and warehouse management workflows with our award-winning ERP.

Let Versa Cloud Erp’s do the heavy lifting for you.

[widget id=”custom_html-40″]

[widget id=”custom_html-42″]

[widget id=”custom_html-30″]

Do Business on the Move!

Make your businesses hassle-free and cut the heavyweights sign up for the Versa Cloud ERP today!!

Join our Versa Community and be Future-ready with us.

[widget id=”custom_html-20″]